Invest

Good conditions in stock markets in 2012

Summary 2012

- Good conditions in stock markets in 2012

- A very good year for Ferd Invest, with an investment return 8.7% better than the benchmark index

- Optimistic outlook for 2013

Markets

2012 was a good year for the Nordic stock markets. The Copenhagen stock exchange was the strongest of the Nordic exchanges, with an upturn of 20.1%, while Helsinki was the weakest with an upturn of 7.8% (in Norwegian kroner terms). At the start of 2012, markets were characterised by concern over the outlook for the global economy, eurozone co-operation and corporate earnings. Even though these concerns were not in any way resolved, we saw a gradual decline in the level of concern about these themes over the course of the year. In our opinion, the main driving factor for the good performance of stock markets in 2012 was increased risk willingness.

A very good year for Ferd Invest, with an investment return 8.7% better than the benchmark index

Investment Return

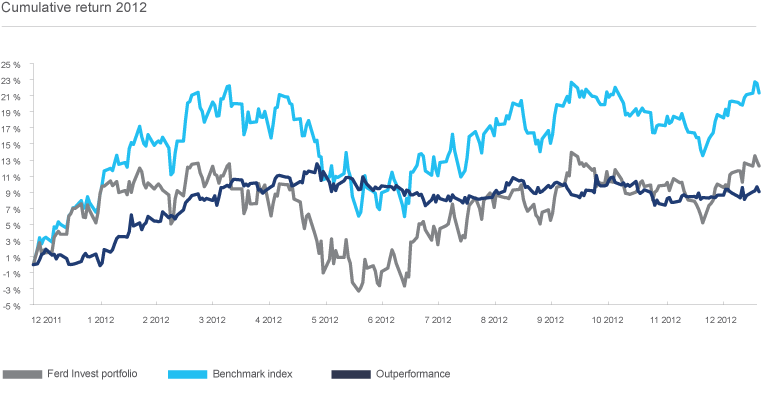

The market value of Ferd Invest’s total portfolio increased by 22.4% in 2012, which was a healthy 8.7% better our benchmark index. The good return was principally achieved by avoiding making particularly bad investments in 2012. Our weakest investments were Millicom and Statoil, which served to reduce our return by around 2 percentage points. Our best investments in 2012 were Swedish Orphan, Electrolux, Wärtsila and Wilh. Wilhelmsen, which in aggregate made a positive contribution of 8.2%.

Ferd Invest’s history of good investment return was further strengthened in 2012. Over the last six years, the return on the portfolio has been significantly higher than the relevant benchmark indices. Our portfolio has outperformed the market by all of 34.7% since 31 December 2006.

Portfolio

At the close of 2012, the market value of the Ferd Invest portfolio was NOK 3.5 billion. Investments were divided between the three Scandinavian stock markets, as well as the Helsinki stock market. The largest investments at the close of 2012 were in Autoliv, Subsea 7, Nokian Tyres, Carlsberg and Opera, and these investments accounted for around 39% of the total value of the portfolio, which comprised 19 investments in total. Our benchmark index is the MSCI Nordic Mid Cap Index.

Optimistic outlook for 2013

Organisation

The Ferd Invest team currently has three members. There were no changes to the Ferd Invest team in 2012.

Future Prospects

Stock market investors are now much less nervous than was the case at the start of 2012. The global economy is still not recovered to good health, and the historically low level of interest rates serves as a daily reminder of this. Despite this, stock markets have risen strongly in recent years. In addition, there seems to be a widely held view that 2013 will again be a good year for the stock market. We find this optimistic view somewhat worrying.

Regardless of the general direction in the stock market, Ferd Invest aims to outperform the market through its selection of individual shares for investment. We have started 2013 with a very clear market view as the basis for our equity investments. We are hoping to see a climate where investors will be properly rewarded for identifying the companies that will produce a strong performance. We are now moving into a phase where it will be ever more difficult for companies to satisfy market expectations for their earnings. If we are able to find the companies that can satisfy these expectations, then we believe that 2013 will be another successful year for Ferd Invest.