Board of Director's Report

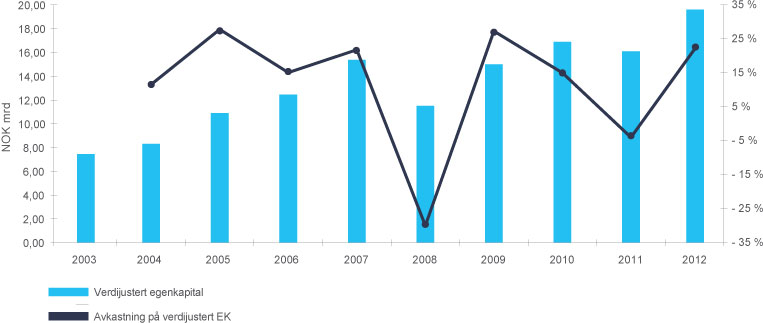

At the close of 2012, the group’s value-adjusted equity was NOK 19.6 billion.

2012 was a very good year for Ferd. At the close of 2012, the group’s value-adjusted equity was NOK 19.6 billion. At the start of 2012, value-adjusted equity was NOK 16.1 billion. After adjusting for dividends, this represents a return of NOK 3.7 billion, equivalent to approximately 23%. The return was better than the market benchmarks, with the Oslo stock market closing the year with a return just over 15%. Ferd’s annual return over the last five years was 5.7%. Over the same period, the Oslo stock market (Oslo Børs Benchmark index) fell by an annual average of 2.0%, and the global equities index (MSCI) produced a return of around zero in Norwegian kroner terms.

These results have been achieved as the result of sound operations and good earnings by the companies in which Ferd holds substantial ownership positions, as well as a sound return from most of the financial investment areas. Both liquidity and capital adequacy have been extremely strong throughout the period, and the company’s risk exposure has been in accordance with the owner’s desired risk profile.

These results have been achieved as the result of sound operations and good earnings by the companies in which Ferd holds substantial ownership positions, as well as a sound return from most of the financial investment areas.

Market sentiment was in general better in 2012. Concern over the European debt crisis eased following the agreement of a new rescue package for Greece. Conditions in the financial markets reflected a reduction in risk margins. The combination of very low interest rates and increased risk willingness was an important driver for the performance of the stock market.

The outlook for global growth remains weak, although there is some variation between regions. The eurozone continues to be in recession. Public spending cuts and debt reduction continue to affect Europe, while in America economic indicators report continuing improvement in the labour market and the residential property market. The situation in the Nordic economies is relatively strong compared to the rest of Europe, although there are some differences between the Nordic countries. The continuing strength of oil prices and the associated high level of activity in the oil sector give grounds to anticipate relatively sound economic growth and low unemployment in Norway. It remains the case that Norway is the strongest economy in the Nordic region, and the outlook remains positive.

The Swedish investment company Ratos and Ferd entered into an agreement in December 2012 to become partners as owners of the oil service company Aibel. The agreement provides for Ferd to maintain a direct ownership interest of approximately 49%, while Ferd’s exposure is significantly reduced. Ferd left its clear footprints through its role in searching for a new partner for Aibel in Norway and Sweden. Over the course of the first half of 2013, Ferd will receive almost NOK 2 billion from the Aibel transaction.

At the close of 2012, Ferd AS (the parent company) had an unused committed credit facility of NOK 2.5 billion. Ferd Capital experienced a high level of activity in 2012, but did not make any major investments in the year. Herkules Fund I sold Pronova to BASF, and sold Beerenberg to a Swedish private equity fund. Ferd will receive almost NOK 1.5 billion from these disposals in the first quarter of 2013. The receipts from Herkules Fund I and the Aibel transaction mean that at the parent company level Ferd will not need to draw on its credit facility in the spring months of 2013. Ferd allocated almost NOK 1 billion to Ferd Invest and Ferd Hedge Funds in the first quarter of 2013. Accordingly, Ferd will still have a sizeable amount of capital available for new investments.

The Board believes that 2013 will offer good investment opportunities for a number of Ferd's business areas, and the Board is confident that Ferd has the financial and organisational resources to ensure that it is well placed to take advantage of the opportunities that arise.

Ferd reorganised its activities in 2012. Prior to autumn 2012, Ferd had separate managers for its industrial and financial investments. Following the reorganisation, Ferd Capital has three managers who between them have portfolio responsibility for all Ferd Capital’s investments. All the business area heads now report to a single investment officer.

The Board believes that 2013 will offer good investment opportunities for a number of Ferd's business areas, and the Board is confident that Ferd has the financial and organisational resources to ensure that it is well placed to take advantage of the opportunities that arise.

The group's value-adjusted equity

Ferd’s target is to achieve average annual growth in value-adjusted equity of at least 10% over time. Over the period 2003-2012, Ferd generated a total return of NOK 13.3 billion, equivalent to an annual return of 12.5%. Ferd achieved this return with less volatility than was seen in the equity markets over this period, hence it is apparent that the risk-adjusted return achieved has been satisfactory.

One important reason for the spread of risk is Ferd’s exposure to diversifying asset classes such as hedge funds and real estate. In addition, Ferd holds a range of equity investments that represents good diversification between different sectors and geographical markets and between companies at different stages of the corporate life cycle. The value of the group’s unlisted investments increased in 2012, and Ferd Capital’s portfolio, taken together with the group’s investments in the Herkules Private Equity Funds, represents over half of Ferd’s value-adjusted equity.

Ferd’s sound return in 2012 reflects strong results from four of the five investment areas. Ferd Capital’s portfolio companies performed well, with the increase in value of Aibel making a particularly strong contribution. Ferd Invest’s Nordic portfolio generated a return of 22%, which was significantly higher than the benchmark index for this portfolio. Ferd Hedge Funds and Ferd Special Investments also reported good returns, both in absolute and relative terms. The picture was somewhat more mixed for Ferd Real Estate's portfolio, where the overall value was virtually unchanged for the year.

Financial results for Ferd AS

Ferd AS is an investment company, and recognition of assets at fair value is of key importance. Accordingly, Ferd presents accounts that report its investments at fair value, including the subsidiary companies of Ferd AS (for further information on this change to accounting principles, see Note 19 to the accounts.

Ferd AS reports operating profit of NOK 3,740 million for 2012, representing an increase of NOK 4,199 million from 2011.

Ferd AS reports operating profit of NOK 3,740 million for 2012, representing an increase of NOK 4,199 million from 2011. In addition to the matters mentioned above, the most important reason for the improvement in profit is a higher return from investments in the Herkules funds relative to 2011. The Pronova share price increased from NOK 7.8 to NOK 12.5 in 2012. Ferd’s return from Pronova in 2012 was in excess of NOK 450 million.

For further commentary on financial results in 2012, the reader is referred to the separate sections on each business area on the following pages.

The company’s distributable reserves amount to NOK 8,742 million. The annual accounts have been prepared on the going concern assumption, and in accordance with Section 3-3a of the Accounting Act, the Board confirms that the going concern assumption is appropriate.

Financial results and cash flow for Ferd (Ferd AS group)

Operating revenue was NOK 14,184 million in 2012 as compared to NOK 9,148 million in 2011. The main reason for the increase in revenue was that in 2012 Ferd recognised to income NOK 3.2 billion in respect of the increased value of shares and equity participations, while in 2011 Ferd recorded a loss of NOK 0.3 billion on financial investments.

Sales revenue increased from NOK 9.3 billion in 2011 to NOK 10.5 billion in 2012. Consolidated sales revenue reported by Ferd for 2012 includes the revenue reported by Mestergruppen and TeleComputing for the full year. The consolidated sales revenue reported for 2011 only included eight months' sales from these companies. Elopak reported operating revenue of NOK 5.9 billion in 2012, down by NOK 0.2 billion from the previous year. The reduction is principally due to the strength of the Norwegian krone since a large part of Elopak’s revenue is denominated in euros.

The group’s financial items showed net expense of NOK 246 million in 2012 as compared to net expense of NOK 189 million in 2011. Exchange rate movements were the main reason for the change in net financial items between 2011 and 2012.

Ferd has a low effective tax rate because a large part of its earnings is generated from investments in shares. Under the exemption model, gains on shares are not taxable. The group’s net tax charge for 2012 was NOK 187 million as compared to a charge of NOK 34 million for 2011.

Net cash flow for 2012 was made up of cash from operations of NOK 299 million, cash from investment activities of NOK 741 million, and cash from financing activities of NOK -990 million. The most important factor in the positive cash flow from investment activities was the inflow of NOK 1.3 billion realised on securities, principally from the Herkules funds and in the form of payments from Special Investments.

Strategy

The overall vision for Ferd’s activities is to ‘create enduring value and leave clear footprints’. Ferd’s corporate mission statement states that the group will hold a combination of well-diversified financial portfolios and industrial investments where Ferd has ownership positions that give it a significant influence. Ferd will accordingly strive to maximise its value-adjusted equity capital over time. Ferd’s owner has set a target for Ferd to generate an annual return on value-adjusted equity of at least 10% over time.

The approach to risk exposure taken by the owner and the Board of Directors is one of the most important parameters for Ferd’s activities. This defines Ferd’s risk bearing capacity, which is an expression of the maximum risk exposure permitted across the composition of Ferd’s overall portfolio. Ferd’s risk willingness, which determines how much of its risk bearing capacity should be used, will vary over time, reflecting both the availability of attractive investment opportunities and the company’s view on general market conditions.

Allocating risk capital is one of the Board’s most important tasks, since return and risk exposure are largely determined by the asset classes in which Ferd invests. The structured allocation of capital reflects the criteria of diversification, how the group uses its capital base, and its risk bearing capacity. The Board continuously monitors Ferd’s risk capacity and whether the actual allocation of assets at any time corresponds with the assumptions and requirements that form the basis for capital allocation.

Ferd’s intention that its capital allocation should be characterised by a high equity exposure and good risk diversification

It is Ferd’s intention that its capital allocation should be characterised by a high equity exposure and good risk diversification. Good risk diversification helps to ensure that Ferd can maintain its exposure to equity investments, even at times when other players have less access to capital. In addition, maintaining strong liquidity enables us to maintain our freedom to operate as we wish even in more difficult times.

Ferd’s equity capital investments represent a well-diversified portfolio, and the overall performance shows a relatively strong correlation with the performance of Norwegian and international stock markets. Ferd Real Estate and Ferd Hedge Funds help to reduce the group’s overall risk exposure, not only because these investments involve less risk than investing in equities, but also because they have a moderate correlation with Ferd’s other asset portfolios over time.

Asset allocation must be consistent with the owner’s willingness and ability to assume risk. This provides guidance on how large a proportion of equity can be invested in asset classes with a high risk of fall in value. The risk of fall in value is measured and monitored with the help of stress testing. The allocation for 2013 anticipates that the risk of fall in value at the start of the year will be lower than has been the case in recent years. The reduction in the risk of fall in value is the result of the realisation of a number of major investments in the first half of 2013. Some of the capital released has already been reinvested, and intensive efforts are being made to put further capital resources to work.

Ferd aims to maintain sound creditworthiness at all times in order to ensure that it has freedom of manoeuvre and can readily access low-cost financing at short notice when it wishes. Ferd strives to ensure that its main banking connections will rate Ferd’s creditworthiness as equivalent to ‘investment grade’. In order to protect Ferd’s equity from unnecessary risks, Ferd Capital and Ferd Real Estate carry out their investments as stand-alone projects without guarantees from Ferd. Both Ferd and its banks pay close attention to liquidity. Ferd has always held liquidity comfortably in excess of the minimum liquidity requirements we impose internally and the requirements to which we are committed by loan agreements at the parent company level. Ferd works on the assumption that the return generated by financial investments should help to cover current interest payments. It is therefore important that the balance sheet is liquid, and that the maturity profile of assets corresponds closely to the maturity profile of liabilities.

Ferd has a proactive approach to currency exposure. We work on the assumption that Ferd will always have a certain proportion of its equity invested in euro, US dollar and Swedish kronor denominated investments, and accordingly do not hedge all currency exposure against the Norwegian krone. In addition, we anticipate that at least half the group’s equity will continue to be exposed to investments denominated in Norwegian kroner. Subject to the actual exposure being within the strategic currency basket, Ferd does not currency hedge its investments. If the exposure to any one currency becomes too great or too small, the composition of the currency basket is adjusted by borrowing in the currency in question at the parent company level, or by using derivatives.

Ferd holds only very limited investments in interest-bearing securities. Its exposure to interest rate risk arises from funding and interest-bearing investments, and is managed by group treasury in accordance with established guidelines.

Further information on Ferd’s strategy can be found in a separate article.

Corporate Governance

Ferd is a relatively large corporate group, with a single controlling owner. In autumn 2012, the owner decided to withdraw from his position as Chief Executive Officer and become the Chairman of the Board of Directors of Ferd Holding AS. The Board of Directors of Ferd Holding AS has substantially the same responsibilities and authority as the board of a public company.

Not all the sections of the Norwegian Code of Practice for Corporate Governance are relevant to a family-owned company such as Ferd, but Ferd complies with the Code where it is relevant and applicable. Further information is provided in a separate article on corporate governance. The Board of Directors held six Board meetings in 2012.

Ferd Capital

Since Ferd Capital was established as a business area in 2007, Ferd has allocated a sizeable amount of capital for new investments. Over the course of this period, Ferd Capital has evaluated a large number of companies and has been actively involved in many potential transactions. Ferd Capital attaches great importance to creating a flow of investment opportunities through its own research and proactive contacts with potential sellers.

Ferd Capital committed a great deal of effort in 2012 to restructuring the ownership of Aibel.

Ferd and Ratos entered into partnership as owners of Aibel in December 2012. Herkules sold 100% of its shares in Aibel. Ferd and Herkules had been considering alternative ownership solutions for Aibel for some time. Herkules wished to sell its investment in the company, whereas Ferd wished to retain and develop its ownership interest in Aibel. Ferd and Herkules evaluated a number of specific possible part-owners of Aibel over the second half of 2012 before finally deciding on Ratos. Ratos was judged a very good partner for Ferd in the further development of Aibel. Ferd and Ratos have expertise and financial resources that will put Aibel into an even better position to realise the strategy the company has pursued over recent years as well as to develop new business opportunities.

When making investment decisions, Ferd Capital attaches only little weight to the overall macroeconomic outlook. Company-specific factors play a crucial role when deciding whether or not investment opportunities are attractive. Through its participation in Streaming Media AS, and in partnership with Schibsted and Platekompaniet, Ferd Capital invested in April 2012 in Aspiro AB. Aspiro’s activities include owning and operating the music streaming service Wimp. This was the Ferd Capital’s only new investment in 2012.

Aibel

Aibel reported turnover for continuing operations of NOK 10,442 million in 2012 as compared to NOK 8,176 million in 2011. EBITDA was NOK 875 million as compared to NOK 801 million in 2011. Aibel continued to build on its strong performance in 2011 by winning a number of major and strategically important contracts in 2012. The company started 2013 with an order backlog of around NOK 20 billion. In addition, the company has a further NOK 19 billion of order options.

Aibel continued to build on its strong performance in 2011 by winning a number of major and strategically important contracts in 2012.

In February, Aibel was awarded a major and strategically important contract by Shell. The contract is a framework agreement for modifications to the Draugen platform. The contract will run for six years, with options for an additional two plus two years, and has an estimated value of NOK 6 billion. Statoil awarded a major upgrading contract for Gullfaks to Aibel. The contract is for upgrading the drilling systems on Gullfaks B, and is worth an estimated NOK 1 billion.

AMEC and Aibel signed a collaboration agreement to work together on potential new projects in Field Development. The agreement will extend Aibel's capacity for executing projects. AMEC is one of the world's leading engineering companies with over 27,000 employees in 40 countries. AMEC can offer resources for all Aibel's business areas.

Market conditions for Aibel in 2013 are attractive, with a reasonably high oil price and expectations of strong growth in investment on the Norwegian continental shelf over the coming years. Aibel is well positioned to progress and win contracts that are expected to be put out to bidding in 2013. Aibel’s main challenge is recruiting new employees, both in its Norwegian activities and elsewhere in the group.

Elopak

Elopak’s business is in general less cyclical than many other industries, and should therefore not experience any major loss of volume as a result of changes in economic conditions. The company expects carton sales for the juice market to be particularly volatile since demand for these products is affected to some extent by the state of consumers’ finances. Elopak’s total revenue was NOK 5,864 million in 2012, compared to NOK 6,088 million in 2011. The main cause for the decline was the strength of the Norwegian kroner in 2012. The number of carton volumes sold was in line with 2011.

Operating profit was NOK 273 million, as compared to NOK 344 million in 2011. The main reason for the decline in profit was a provision made for restructuring its factories in Europe. One consequence of this restructuring was that activity at the Speyer factory in Germany was scaled down.

There are many indications that Elopak will continue to face a challenging market situation in 2013. European markets continue to be affected by uncertainty over the outlook for growth, with concerns over unemployment and financial stability. The situation in North America is more encouraging.

Raw material prices are expected to continue to be volatile in 2013. The high price of crude oil affects the cost of hydrocarbon-based raw materials, which account for around one-sixth of the company’s total raw material costs. Elopak has hedged part of its expected purchases of polyethylene.

The Board believes that Elopak is well positioned to meet these challenges. Elopak will continue to invest in new infrastructure in 2013 that will contribute to future growth. The new factory in Russia will give Elopak a stronger position in a growth market. Further, Elopak will continue its efforts to develop aseptic packaging technology.

TeleComputing

TeleComputing reported operating profit of NOK 116 million in 2012, in line with 2011. The company achieved continuing strong growth in 2012 for its core business of supplying IT operating services. TeleComputing's consulting activities, which are delivered through its subsidiary company Kentor, experienced a challenging year as a result of lower demand for consulting services in the Swedish market. Revenue increased by 4% in 2012. The company was again successful in 2012 in securing renewals of many important customer contracts, while at the same time attracting many new customers. This resulted in a larger order backlog at the end of 2012 than at any time in the company's history. TeleComputing’s objective is to maintain industry-leading profit margins. This was again achieved in 2012, even though the challenges facing the Swedish market had an adverse effect on bottom-line profit.

Telecomputing was again successful in 2012 in securing renewals of many important customer contracts, while at the same time attracting many new customers.

Mestergruppen

Mestergruppen reported revenue of NOK 2,777 million in 2012, representing organic growth from 2011 of just under 5%. Normalised EBITDA was NOK 78 million compared to NOK 71 million in 2011. Mestergruppen launched a number of improvement and growth initiatives in 2012. Additional resources were committed to improving the purchasing and logistics functions, and these programs together with the launch of a new concept for building professionals are expected to produce positive results in 2013.

In June 2012, Mestergruppen acquired the Ålesund-based building products distributor Alf Valde. This transaction was part of the company's strategy to strengthen its position in selected geographic areas.

Mestergruppen intensified its focus on development projects in 2012, and this included the launch of a residential development project in collaboration with Ferd Real Estate for a large site adjacent to Strømmen station.

Interwell

Interwell is a leading Norwegian supplier of high-technology well solutions for the international oil and gas industry. The company reported revenue of NOK 494 million in 2012, an increase of almost 30% from 2011. Revenue growth was principally driven by the company's successful international expansion.

Interwell’s operating profit (EBITDA) for 2012 was NOK 180 million, an improvement of NOK 44 million from the previous year. The company's most important market is the Norwegian continental shelf, but over recent years it has also established local operations in the Middle East and in the USA. Interwell reorganised its activities in the Middle East in 2012, setting up a subsidiary and regional office in Dubai to serve this region. Statoil is Interwell’s largest customer, and the company maintains a close dialogue with Statoil both on operational issues and on the development of new solutions in order to ensure that it will be able to satisfy Statoil’s future requirements. During the course of 2012 the company completed the development of several new products that will play an important role in complementing and expanding its product portfolio, as well as contributing to its ambitious growth strategy.

Swix Sport

Swix Sport reported operating profit (EBITDA) of NOK 51 million for 2012 as compared to NOK 66 million in 2011. Revenue increased from NOK 604 million in 2011 to NOK 687 million in 2012. Swix strengthened its presence in the outdoor segment through its acquisition of Lundhags. Original Teamwear AS continued to strengthen its leading position in Norway for sports clothing sales to B2B and sports clubs. Swix acquired the remaining shares in Original in June 2012.

2012 was affected by challenging market conditions as a result of a short and warm winter season and high stock levels in the distribution network. Despite this, Swix reported a strong outcome for 2012 with a positive bottom line. With a greater focus on exports and the acquisition of Lundhags, Swix generated approximately 50% of its revenue in 2012 from markets other than Norway, an increase of 6 percentage points from 2011.

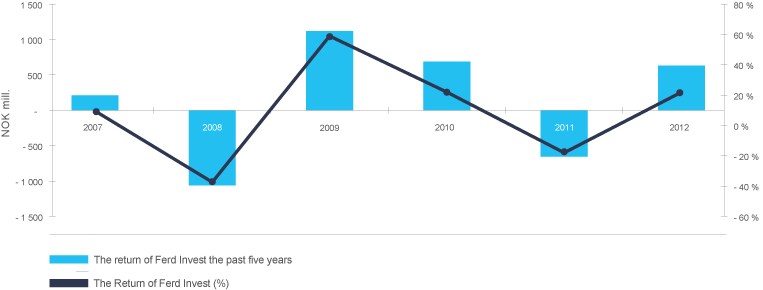

Ferd Invest

Ferd Invest reported an operating profit of NOK 631 million for 2012 as compared to an operating loss of NOK 662 million for the previous year. 2012 was a good year for the Nordic stock markets overall, with an improvement of 14% (MSCI Nordic Mid Cap Index). The Nordic exchanges performed well in 2012. The Copenhagen stock exchange was the strongest of the Nordic exchanges, with an upturn of 20%, while Helsinki was the weakest with an upturn of 8% (in Norwegian kroner terms). At the start of 2012, markets were characterised by concern over the outlook for the global economy, eurozone co-operation and corporate earnings. Even though these concerns were not in any way resolved, we saw a gradual decline in the level of concern over the course of the year. The Board is of the opinion that the main driving factor for the good performance of stock markets in 2012 was increased risk willingness.

The market value of Ferd Invest’s total portfolio increased by 22% in 2012, which was 9 percentage points better the index against which Ferd Invest benchmarks its performance.

he market value of Ferd Invest’s total portfolio increased by 22% in 2012, which was 9 percentage points better the index against which Ferd Invest benchmarks its performance.

At the close of 2012, the market value of the Ferd Invest portfolio was NOK 3.5 billion. Investments are divided between the three Scandinavian stock markets, in addition to the Helsinki stock market. The largest investments at the close of 2012 were in Autoliv, Subsea 7, Nokian Tyres, Carlsberg and Opera, and these investments accounted for around 39% of the total value of the portfolio, which comprised 19 investments in total.

Stock market investors are now much less nervous than was the case at the start of 2012. The global economy is still not recovered to good health, and the historically low level of interest rates serves as a daily reminder of this. Despite this, stock markets have risen strongly in recent years. In addition, there seems to be a widely held view that 2013 will again be a good year for the stock market. In view of the challenges facing the global economy, the Board finds this optimistic view somewhat worrying.

Ferd’s objective for the management of its hedge fund investments is to achieve a satisfactory risk-adjusted return over time, both relative to the market and in absolute terms. In order to achieve good risk diversification, it is important that the composition of the portfolio features a range of funds which generate returns that are not dependent on the same risk factors. In addition, as part of risk diversification for Ferd’s overall portfolio, the hedge fund portfolio normally has a relatively small weighting in funds that are heavily exposed to the stock market.

The hedge fund market, as represented by the HFRI Composite Index, was up by 6.4% in 2012. A number of hedge fund strategies were particularly visible due to the strength or weakness of their performance in 2012. Macroeconomic funds produced weak returns, although, not surprisingly, we saw some big differences between individual funds. Funds with credit-related strategies were among the most successful in the hedge fund sector in 2012.

Ferd Hedge Fund

Ferd’s objective for the management of its hedge fund investments is to achieve a satisfactory risk-adjusted return over time, both relative to the market and in absolute terms. In order to achieve good risk diversification, it is important that the composition of the portfolio features a range of funds which generate returns that are not dependent on the same risk factors. In addition, as part of risk diversification for Ferd’s overall portfolio, the hedge fund portfolio normally has a relatively small weighting in funds that are heavily exposed to the stock market.

The hedge fund market, as represented by the HFRI Composite Index, was up by 6.4% in 2012. A number of hedge fund strategies were particularly visible due to the strength or weakness of their performance in 2012. Macroeconomic funds produced weak returns, although, not surprisingly, we saw some big differences between individual funds. Funds with credit-related strategies were among the most successful in the hedge fund sector in 2012.

Ferd Hedge Fund’s portfolio achieved a return of 7.8% in USD terms in 2012, outperforming its benchmark index (HFRI Fund of Funds Conservative) by 3.7 percentage points.

Ferd Hedge Fund’s portfolio achieved a return of 7.8% in USD terms in 2012, outperforming its benchmark index (HFRI Fund of Funds Conservative) by 3.7 percentage points. The return for 2012 in Norwegian kroner terms was NOK 129 million, and total assets at the close of the year were approximately NOK 1.7 billion.

Portfolio turnover was somewhat higher in 2012 than the historic average. It is satisfying to note that the overall effect of the changes made had a positive effect on the return for the year. Ferd Hedge Funds’ investment process focuses principally on finding competent investment managers, but some changes were also made in the first half of 2012 to the portfolio's exposure to various hedge fund strategies.

Ferd Special Investments

The investment mandate for ‘Special Investments’ was put in place in spring 2010, and Special Investments became a separate business area in autumn 2012. The objective for this business area is to benefit from investment opportunities that Ferd is well placed both to evaluate and hold, but which fall outside the group’s other mandates.

Investments held in this portfolio share the common feature of a favourable balance between the potential return and the risk of loss. Particular attention is paid to being able to identify good protection against downside risk. Investment opportunities that satisfy the portfolio’s objective have been identified in the secondary market for hedge fund units, where imbalances between the number of buyers and sellers of these units have allowed Ferd to purchase units at a discount. Funds allocated to the portfolio since its launch total NOK 1,450 million. The return since the portfolio was established is NOK 320 million, while the return in 2012 in isolation was NOK 182 million. These figures represent annual returns of 15% and 14% respectively.

Ferd Special Investments invested NOK 665 million through 13 transactions in 39 funds in 2012. NOK 522 million was realised from existing investments in 2012. Ferd’s Special Investments portfolio amounted to around NOK 1.8 billion at the close of 2012.

Ferd’s Special Investments portfolio amounted to around NOK 1.8 billion at the close of 2012.

Ferd Special Investments continue to believe that there will continue to be opportunities to work with hedge fund managers to provide additional capital for specific investments in order to subsequently realise the full value potential of these investments. Ferd Special Investments participated in an investment of this type in 2012 of approximately NOK 300 million.

Ferd Real Estate

Ferd Real Estate is an active real estate investor, involved both in real estate development and asset management. Over the course of 2012, the business area increased Ferd's exposure to real estate, and this included two new major development projects.

Ferd Real Estate's portfolio is valued at NOK 1.5 billion, and generated a negative return on value-adjusted equity of 1% for 2012.

Ferd Real Estate reports an operating profit of NOK 325 million for 2012 as compared to NOK 79 million in 2011. The development site for phases 5 and 6 of Tiedemannsbyen (a residential development project at Ensjø in Oslo) was valued in 2012 at estimated fair value based on the development of the site as a residential development project. Prior to 2012, this part of the Tiedemanns complex has been recognised for accounting purposes on the basis of the value of its current use as warehouse premises.

The portfolio is valued at NOK 1.5 billion, and generated a negative return on value-adjusted equity of 1% for 2012.

The negative return was largely due to downward adjustment of valuations of development sites for warehousing/logistics facilities, partly because the process of planning permission for these sites is taking somewhat longer than anticipated and partly because market demand is for the moment somewhat lower than forecast when these investments were first made.

All Ferd Real Estate’s existing office premises and warehouse facilities are currently virtually fully let.

Despite a large number of recently completed new office buildings, the combination of strong conditions in the labour market, conversions of existing office buildings to residential developments and the temporary removal of office buildings from the market for renovation has resulted in falling vacancy rates in the Oslo area and rising rental levels. There were more transactions in commercial property in 2012 than in 2011, despite more challenging conditions in the lending market. Residential real estate prices again increased in 2012, with prices for apartments in Oslo rising by around 9%. There is still an imbalance between the supply of new residential units and demand. There is a shortage of residential development sites in central locations, and prices have risen markedly over the recent years.

Tidemannsbyen launched the first sales phase of its residential project in spring 2010. The remaining units in the first sub-area, representing 199 townhouses and apartments, were all sold in 2012. Residential purchasers are showing increasing interest in Ensjø and Tiedemannsbyen in pace with the development of Ensjøbyen as a new residential area. Ferd Real Estate expects to start the next phase of construction in 2013.

Fewer new office buildings are due for completion in the Oslo area than in 2012. Since macroeconomic conditions continue to be favourable and vacancy levels for office space continue to fall, particularly for central locations, the Board believes that rental levels for office space will continue to rise in 2013. The Board is of the opinion that given the stable outlook for the Norwegian economy, the level of interest in the Norwegian real estate sector will be maintained.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs who reflect Ferd’s vision of creating enduring value and leaving a clear footprint.

Ferd Social Entrepreneurs has chosen to apply a focused strategy for its interpretation of social entrepreneurship. Social entrepreneurs must play a part in solving social problems while at the same time demonstrating a good likelihood that their activities will be financially self-sufficient over time. FSE principally supports social entrepreneurs who work with children and young people.

2012 was the most exciting and demanding year ever for FSE. The year demonstrated that social results can be achieved, but also showed how challenging it can be to succeed as a social entrepreneur. FSE’s operational model and systems are in place, its main activities are defined and its portfolio of social entrepreneurs is almost at full strength with 11 social businesses. FSE invested in two new social entrepreneurs in 2012: Intempo and Lyk-z. The social entrepreneurs Gladiator and Trivselsleder extended their activities beyond Norway, which is an important milestone. Forskerfabrikken (the Scientist Factory) celebrated its 10th anniversary in 2012, and arranged summer schools for almost 1,000 children. FSE held the annual VelFERD conference, with 364 participants.

The Board of Ferd Holding AS has allocated up to NOK 20 million annually for work with social entrepreneurship. In addition, Ferd's other business areas and subsidiaries support social entrepreneurs with their time and commitment as board members and through other assistance.

Health, safety, environmental matters and employment equality

Recent years have seen increasing emphasis on environmental issues in the industrialised countries of the world. None of the group’s activities produces discharges that require licensing and environmental monitoring.

Elopak operates in an industry where both customers and suppliers are very aware of global warming, CO2 emissions, carbon footprint, product lifecycle and recycling the materials used. Relative to alternative forms of packaging, carton-based packaging rates very highly on these criteria. Elopak only uses carton board sourced from forestry that is managed in accordance with sustainable principles. Over the period from 2007 to 2011, Elopak reduced its overall CO2 emissions by 16%, and a further 2% reduction was achieved in 2012. Elopak has established new and ambitious targets for the period through to 2020.

The Ferd group had 3,609 employees in 2012, and 22% of employees are female.

Sick leave amounted to 3.1% for the Ferd group in 2012, as compared to 3.6% in 2011. Ferd AS had 39 employees at the close of 2012, of which 26 are male and 13 are female. No serious accidents or injuries were reported at Ferd AS in 2012.

It is the company’s policy to treat female and male employees equally. This is reflected in a policy of equal salaries for equal responsibilities, and a recruitment policy that emphasises the selection of candidates with the right expertise, experience and qualifications to meet the requirements of the position in question. The company strives to be an attractive employer for all employees, regardless of gender, disability, religion, lifestyle, ethnicity or national origin.

The Board of Directors of Ferd AS comprises one female director and four male directors.

Allocation of the profit for the year

It is proposed that the profit for the year of NOK 3,629 million should be allocated as follows:

| Proposed dividend | 27 | |

| Group contribution paid | 18 | |

| Transferred to other equity | 3,584 | |

| Total allocations | 3,629 |

Bærum, 8 April 2013

The Board of Directors of Ferd A